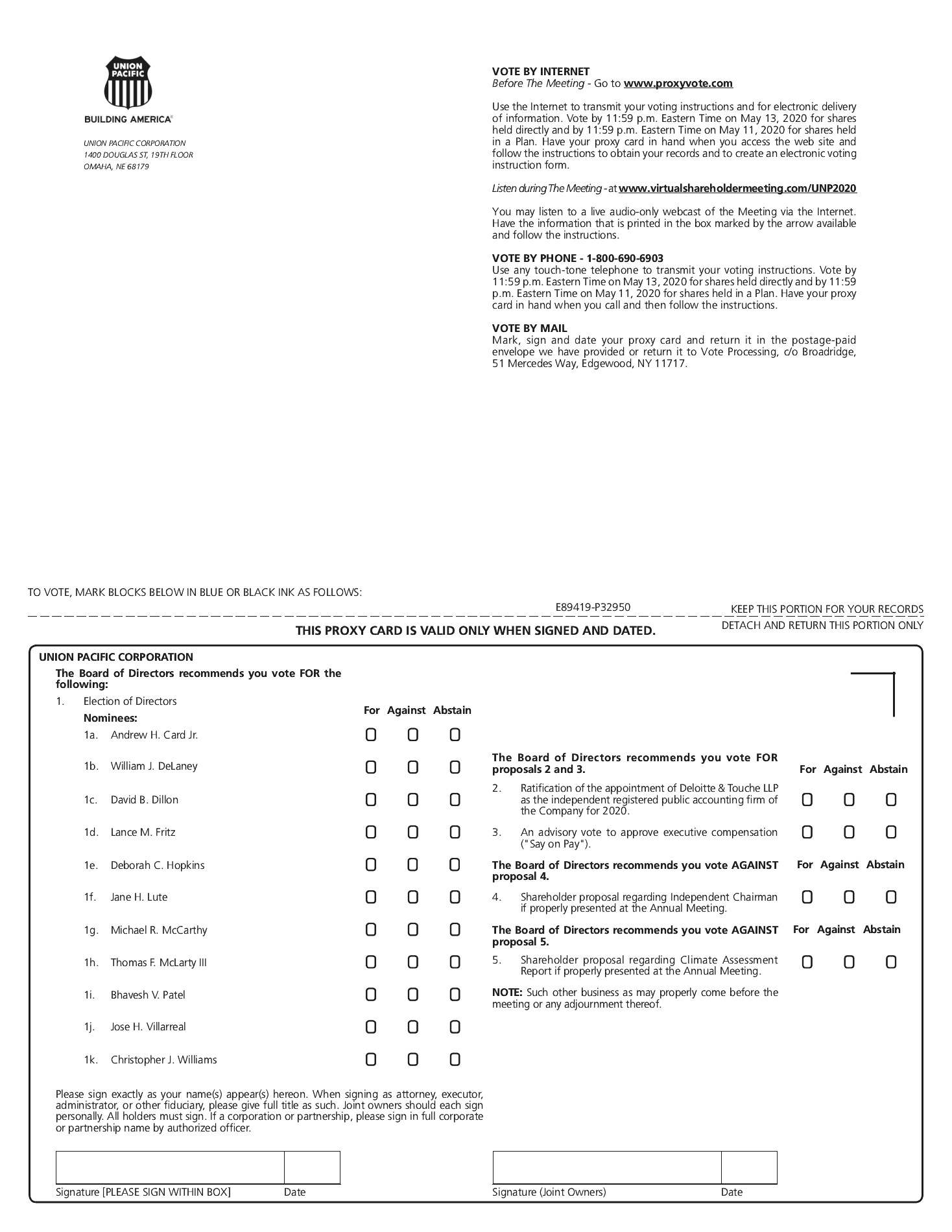

PROPOSAL NUMBER 5 – Shareholder Proposal Regarding Climate Assessment ReportJames McRitchie, 9295 Yorkship Court, Elk Grove, CA 95758, who reported owning 80 shares of the Company’s common stock, has submitted the following proposal. The proposal and supporting statement are presented as received in accordance with SEC rules, and the Company disclaims any responsibility for their content.If properly presented at the annual meeting by or on behalf of the proponent, the Board of Directors recommends a vote AGAINST this proposal.

Resolved: Shareholders request Union Pacific (or “Company”) issue a report, at reasonable cost and omitting proprietary information, describing if, and how, it plans to reduce or offset its total contribution to climate change and align its operations with the Paris Agreement’s goal of maintaining global temperature increases well below 2 degrees Celsius.

Supporting Statement: Shareholders seek information, among other issues reported at board and management discretion, on the relative benefits and drawbacks of integrating actions, such as:

Adopting overall short-, medium-, and long-term, absolute greenhouse gas emissions reduction targets for the Company’s full carbon footprint, aligned with the Paris Agreement;

Increasing the scale, pace and rigor of initiatives aimed at reducing the carbon intensity of Union Pacific’s services and operations;

Increasing investments in route and switchyard electrifications [https://grist.org/climate-energy/how-we-can-turn-railroads-into-a-climate-solution/], as well as renewable energy resources, such as wind and solar.

Background: In 2018, the Intergovernmental Panel on Climate Change advised that net carbon emissions must fall 45% by 2030 and reach net zero by 2050 to limit warming below 1.5 degrees Celsius, thereby preventing the worst consequences of climate change.

The Fourth National Climate Assessment report (2018) finds with continued growth in emissions, “annual losses in some U.S. economic sectors are projected to reach hundreds of billions of dollars by 2100.”

Climate change impacts present risks to investors such as increased supply chain disruptions, reduced resource availability, lost production, commodity price volatility, infrastructure damage, political instability, and reduced worker efficiency, among other factors that can disrupt company operations.

The U.S. Energy Information Administration identifies the transportation sector as the largest producer of greenhouse gas emissions and its emissions are steadily increasing.

Union Pacific has implemented various initiatives to improve efficiency and reduce emissions, but greenhouse gas emissions from its locomotives increased from 2017 to 2018. While Union Pacific does have a modest goal of reducing locomotive fuel consumption by 1.5% in total from 2018 through 2020, the company lacks comprehensive greenhouse gas reduction goals and plans.

More than 690 leading companies, including DHL Group, have committed to reduce emissions in line with Paris Agreement goals. Deutch Bahn (a German railway company with 318,000 employees) has a goal to use 100% renewable energy by 2038 [https://ir.deutschebahn.com/en/news-presentations/news/detail/deutsch-bahn-is-focusing-solely-on-powerful-rail/]

Ramping up the scale, pace and rigor of climate-related efforts may help Union Pacific unlock opportunities for growth as major business customers demand environmental accountability from suppliers. It may also help prepare for future carbon-related regulations.

Similar resolutions won majority votes recently at Genesee & Wyoming [https://engagements.ceres.org/ceres_engagementdetailpage?recID=a0I1H00000C4a0TQAR], Anadarko, Exxon Mobil, Kinder Morgan, Middleby, Occidental, and Range Resources.

Given the impact of climate change on Union Pacific, the economy, environment, and human systems, and the short amount of time in which to address it, our Company has a clear responsibility to investors and stakeholders to account for whether, and how, it plans to reduce or offset ongoing climate contributions.

Vote FOR Climate Assessment Report – Proposal 5